My favourite part of working in this industry has always been getting to present our work to our clients. But when I look back on those meetings 10 years ago, the conversation was different:

Me: « Thank you for inviting us to present this 30-page report, Ms Client. We’ve prepared a number of key insights based on the 50 metrics we’re tracking for you that we think you’ll find quite useful and interesting.

Client: « That’s great, but I’ve already had a quick read of it and I’d like to skip to page 15 – that last paragraph was really interesting and I’d like to hear more about that.

*Cue an hour-long discussion about page 15, paragraph 4*

Those long hours we put into that 30-page report were fine, but page 15, paragraph 4 – that’s the story that mattered.

25 years ago, that 30 page report was just a massive stack of clippings. PR measured its effectiveness with a ‘thud factor’ – literally the sound that stack of clippings made as it hit the desk. The louder the thud, the better the result.

Today, our industry has replaced the thud factor and the 30 page report with a sea of data. There are platforms popping up every day that can instantly give you lots of numbers and dashboards and trends over time. And the temptation is to get them all. If you have all the numbers, you have all the answers… Right?

Nope. All of these dashboards and widgets and excel downloads full of data – they’re effectively a digital thud factor.

Measurement is about making that data impactful, compelling, and memorable by telling a story. A story knows its audiences and its objectives, just like a great piece of PR work.

And a good measurement story should be focused on demonstrating the effectiveness of your work. Let me give you an example from the challenger banking sector.

For those of you who aren’t familiar with challenger banks, they’re an exciting place to work if you’re in PR. Challenger banks are bringing faster and more convenient approaches to digital banking, coupled with lower operating costs because they don’t have branches in the traditional sense. So, imagine you work for the comms team at one of these challenger banks – Starling Bank. Back in August, you had a fantastic story to share – the bank managed to triple its deposits in just nine months, despite being in the middle of a pandemic. And you managed to get some legs on the story too – it landed in major dailies, financial and business press.

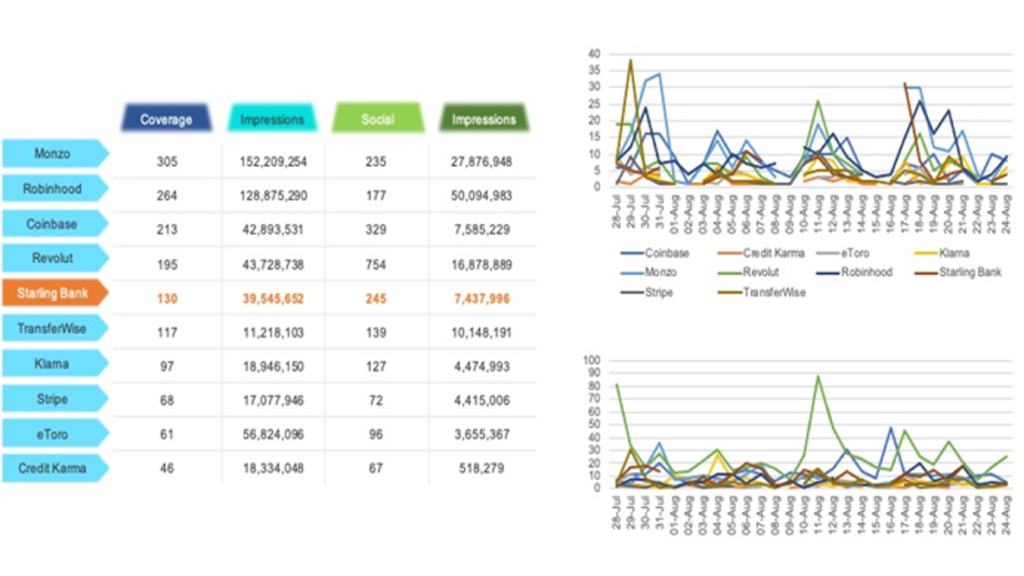

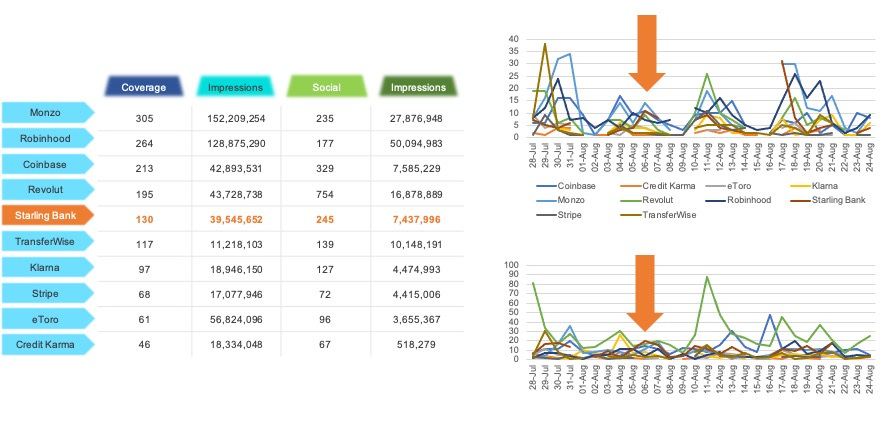

But when it came time to present your results to the board, you presented a typical PR report – a table full of numbers and a few charts. You subscribe to a range of monitoring services, so you have data on news stories, social conversations, web traffic, search trends, and you’ve even benchmarked yourself against other emerging Fintech brands.

But if you’ve ever presented a table of numbers to your board before, you know the questions that come next:

- “What am I looking at?”

- “How do I know these numbers are good?”

- “If we had such a good month, why aren’t we at the top?”

These questions are frustrating. Demoralizing. And unnecessary.

Let’s start with: what is the story you want to be able to tell? I’m going to take a big leap and say it’s the same story that any PR would want to tell about any piece of work: That what you wrote caused your audience to think something and do something that mattered to your business. That’s what we call ‘outputs – outtakes – outcomes’. If you wrote that announcement about Starling’s performance, you would want people to read your coverage and then do something – share the news, look for more information, or even sign up for an account.

This is the story we can actually tell.

If we take that table full of data and look at it in another way, we immediately see an interesting trend on the 6th of August.

Coverage peaked with the news of the bank’s record deposits, social conversations spiked as people shared the news, and there was also an uplift in people searching for Starling Bank on Google. These spikes or peaks indicate that the communication team’s coverage helped generate conversations and active interest in finding out more about the bank.

Linking Outcomes with Business Growth Objectives

Now, we don’t work for Starling Bank at CARMA, but if we did, we would tell an even better story by looking at the data around new account sign-ups or enquiries. Then we’d show how the PR team’s work contributed to audiences thinking about Starling Bank, searching for more information, and ultimately taking the action to engage with the bank.

That story tells how the PR team delivers tangible results that matter to the rest of the business.

So where does this leave you?

Well, you have all of this data – your digital thud factor. But if it’s not telling your story, then it’s not demonstrating how your work contributes impactful results for your organisation.

At CARMA, we work with a lot of data, but we start with the belief that data is only useful if you know what you’re looking for – if you know the story you want to tell. Before we even look at the data, we start by helping our clients zero in on the stories they want to tell and the insights that will make a real difference to the way they work – and then we measure their work in a way that is focused on finding those insights, so we don’t waste time producing 30 pages of thud factor.

But sometimes it’s also just a conversation. Some brands come to us because they just need ideas. Maybe they’re not quite ready for a huge change in how they measure – or maybe they’re building their own insights teams.

Whether you’re looking for a new and best practice measurement solution full stop, or whether you just want a bit of direction, we’d love to share our ideas with you.

The bottom line is – If there’s good work that’s been done, there’s probably a good story to tell.

Download the Fintech Report here.

Watch the on-demand webinar here.

This article was written by Alison Williams, CARMA’s Client Services Director. Having spent over a decade in the media industry, Alison has become a trusted consultant to global brands, designing multi-market measurement programs for communications teams across traditional, digital and social media. At Carma, she manages a team of experienced consultants in the UK and USA, ensuring the delivery of measurement programs which are flexible, actionable, and industry-leading. On the weekends, Alison keeps busy running after her toddler, experimenting in the kitchen, exploring London on her bike and planning her post-lockdown travels.