This year’s annual AMEC (International Association for the Measurement and Evaluation of Communication) Member Survey was conducted smack bang in the middle of the COVID-19 pandemic sweeping across the globe. CARMA’s Global co-managing partner, CEO Europe and Americas, and AMEC Chair Richard Bagnall, recently presented the survey’s findings during the AMEC 2020 Virtual Summit back in July. Key questions were posed across the different member categories (PR Agencies, measurement vendors, in-house teams, independent consultants) to understand the impact being felt within the communications industry and across member regions.

So, what were the highlights?

Industry growth

-

Expectations for growth in the coming year is less optimistic versus expectations in 2019

In the 2019 survey, 79% of members predicted growth in the coming year. Now expectations are, understandably, comprehensively more negative, with 12% predicting a significant contraction and only 44% predicting growth – a palpable fallout from the pandemic.

-

Over a third of members reported up to half of their business either halted or completely stopped

Overall, members indicated a negative impact to new sales and business activity, with 35% saying that up to half of their business has either halted or stopped completely. Cash-flow management was of particular concern with collection issues and decreased budgets.

-

PR agency members reported a significant 75% reduction in client activity and were most impacted by the pandemic.

Independent consultants also experienced a similar, 71% drop in business.

-

However, agency members do feel confident of a strong bounce back.

Albeit with increased pricing, costs and competition pressures. Nearly a quarter of measurement vendors indicated a business reduction, with 62% reporting ‘business as usual’. Six in ten members (62%) anticipate organic growth (existing clients), up from 54% in 2019.

-

Over half of in-house members experienced a sharp rise in business activity.

This was driven by the need for increased external and internal communications to employees, clients, vendors, and other relevant stakeholders to their business.

Measurement practices

-

Close to three quarters of members intend to focus their growth strategy around offering clients more consultant/professional based services.

“There is a clear need to value expertise, this is not an industry that’s only about tools, dashboards and SaaS products” – Richard Bagnall, CEO Europe and Americas, CARMA.

-

Organizations are gearing up their integrated measurement services.

This year, a new survey question was posed and resulted in 58% of members reporting they are actively building their capability to offer Integrated Measurement Services.

“I used to make tools my first order of business, now I really understand it’s about organization, people and data.” – Jamin Spitzer, Senior Director of Comms Insights, Microsoft

-

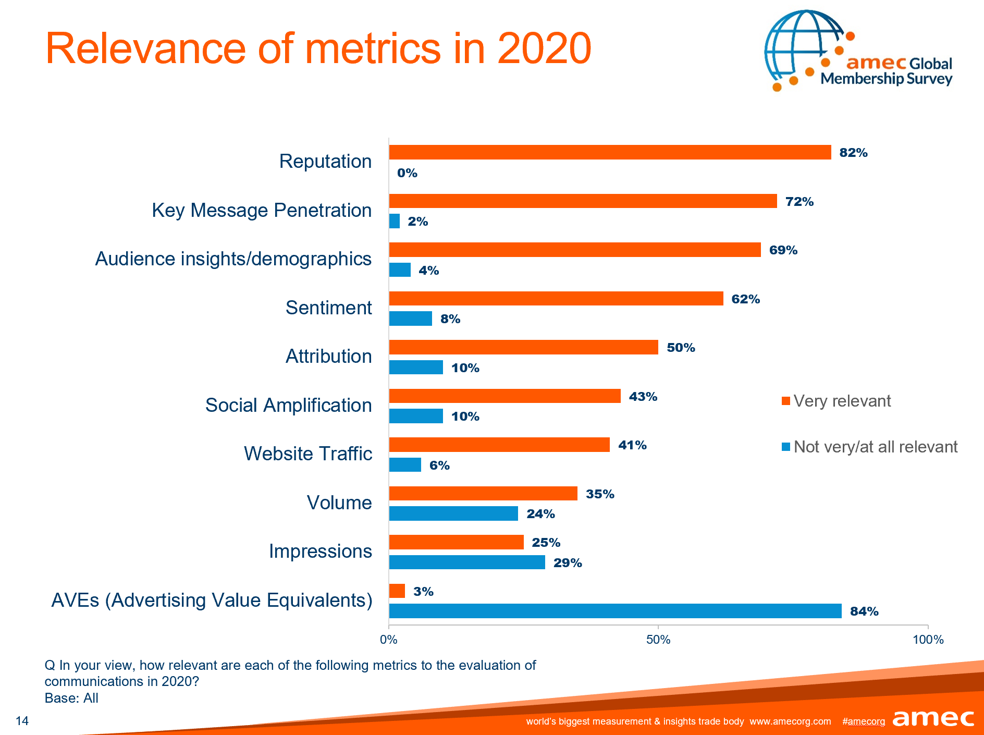

There is an increased demand for more sophisticated types of evaluation and insights

A common trend has been an increased demand for insights, provided by more sophisticated types of evaluation of key messages, reputation, demographics and audience insights, to demonstrate the benefits of communications activity, particularly across Asia Pacific and Latin America where the industry might have once expected a more metric-oriented approach.

-

AVE (Advertising Value Equivalency) metrics are increasingly being recognized as low-value ‘vanity metrics’

AVEs are no longer recognized as meaningful measure of results and communication efforts according to 84% of members. Measuring reputation was of most importance to comms professionals. According to Spitzer “seek intent measuring complex themes, getting past product, meet your audiences where they are”. AVE’s do not get you where you need to go – Jason Weekes explores this in his piece exploring the latest iteration of the Barcelona Principles. In fact, there are 22 reasons to say no to AVEs, according to Richard Bagnall.

AMEC members continue to strongly support best practice measurement and evaluation in communications. The Integrated Evaluation Framework (IEF) and the Measurement Maturity Mapper (M3) are free tools available to PR agencies, in-house teams, consultants and clients. CARMA has embraced these two initiatives and frequently conducts client workshops to support training and education.

Let’s not beat around the bush, the Member Survey is bleak in places, particularly when we reflect on how the pandemic has impacted the industry. But there are glimmers of light – a shift towards integrated practice, a heightened offering of consultancy services and many ready to bounce back. If 2020 has taught us all anything, it’s that we cannot predict what the future holds for us, personally or professionally. Agility, adaptability and commitment to best practice methodologies have proven to be essential in navigating through this time of uncertainty, for both ourselves and in service to our clients.

Sarah Nahawi is the MD of Strategic Partnerships for the MENA region and is based in Dubai. She has been with CARMA for nearly 18 years and loves everything monitoring and measurement. Sarah is passionate about family, friends, ancient history and travel. While raising six children, with her equally busy husband, she loves to listen to podcasts and the latest political news.